Acne is a skin condition which is characterized by pimples, blackheads, and whiteheads.To actually cure acne, one needs to get to the core of the acne problem, not just mask its symptoms.Almost everyone will develop acne, to some degree.Using astringent lotions, pads that remove oil, and medicated bar soaps can help keep the skin clean, but will probably not prevent you from having further acne problems.Most people get acne on their face, back, or chest, but it can also appear on other parts of the body, including the arms and thighs.As toxins are released from the body via the skin, acne may be triggered.Most people will get mild cases, some moderate, and a few people will get severe cases.One can experience embarrassment and anxiety about their appearance.It this sebum is secreted faster than it can pass through the skin pores, a blemish develops.Factors that may contribute to acne include diet, hormonal imbalance, heredity, oily skin, menstrual cycles, stress, allergies, and the use of certain kinds of drugs.

Prescription medications and lotions may help, but will most likely not cure you of acne.Therefore, achieving hormonal balance will cure acne naturally, and have a longer-lasting effect.The largest organ of the body is the skin.This may lead to social withdrawal, depression, and mood changes. Following a natural acne treatment plan that involves balancing your hormones allows your body to heal itself from the inside and is more effective in the long run.When the liver and kidneys are unable to fully discharge body toxins, the skin then begins to help out.In acne treatment, there is a difference between skin care and acne cure.External acne treatments normally mask the symptoms and are more short term.It is important to keep the skin’s pores clean and open, but acne may still result.

Balancing the natural testosterone and estrogen found in the male and female body gets to the source of the problem.Along with the obvious physical symptoms of acne, there can be an emotional impact as well.Teens are not the only ones to get it.It generally affects those between the ages of 12 and Acne often starts at the onset of puberty, when the body increases its production of androgens, which are the male sex hormones.Curing your acne by natural treatment involves cleansing the skin from the inside.When there is excess estrogen and excess testosterone, as is common in the teenage years, acne may result.It is the most common of all skin disorders and is most often found on the face, neck, back, and chest.One function is to help eliminate toxins from the body by sweating.These hormones stimulate of sebum which is an oily skin lubricant.

Posted by wongdezo at 10/16/2009

Labels: skin care,health,insurance,sleep,children Healthy Tips

7 Things Seniors (and Everyone Else) Should Know About FDIC Insurance

0 commentsOlder Americans have their money ... ... and their confidence in the FDIC-insured bank accounts because they want to be calm on the savings that we worked so hard over the years accumulate. Here are some things seniors should know and remember about FDIC insurance.

1. The basic insurance limit is $ 100,000 per depositor per insured bank. If you or your family have $ 100,000 or less in all your deposit accounts at the same insured bank, you do not have to worry about their insurance coverage. Your funds are fully insured. Your deposits in banks are separately chartered separately insured, even if the insured bank, as belonging to the same parent company.

2. You may be entitled to more than $ 100,000 in coverage at one insured bank if you own deposit accounts in different ownership categories. There are several different ownership categories, but the most common for consumers as a single ownership accounts (for one owner), joint ownership accounts (for two or more people), self-directed retirement accounts (individual retirement accounts and Keogh accounts for which you choose how and where the money is deposited) and revocable trusts (a deposit account saying the funds will go to one or more named beneficiaries when the owner dies). Deposits in different ownership categories are separately insured. This means that one person can have more than $ 100,000 of FDIC insurance at the same bank where the funds are in separate ownership categories.

3. A death or divorce in the family can reduce the FDIC insurance. Let's say two people own account and one dies. The FDIC rules allow six-month period after the death of the depositor, the survivors or estate executors a chance to restructure accounts. But if you fail to do six months, the risk of the accounts takes place over $ 100,000 limit.

Example: a man and a woman have a common account "right of survivorship," Common provisions of joint accounts specifying that if one person dies another all their own money. The account totals $ 150,000, which is fully insured because there are two owners (which is up to $ 200,000 to cover). But when one of the two co-owners dies the surviving spouse does not change the account within six months, $ 150,000 deposit automatically would be insured only to $ 100,000 as the surviving spouse's single-ownership account, together with all other accounts in that category in Bank. Result: $ 50,000 and more would be over the limit of insurance for risk of loss if the bank failed.

Also be aware that the death or divorce of a beneficiary of trust accounts can reduce insurance premiums immediately. There is a period-six months in these situations.

4. No depositor has lost a single cent FDIC-insured funds as a result of a failure. FDIC insurance only comes into play when the FDIC-insured banking institution fails. And, fortunately, failed banks are now rare. This is largely because all FDIC-insured banking institutions must meet high standards for financial strength and stability. But if your bank were to fail, FDIC insurance will cover your deposit accounts, dollar for dollar, including principal and interest, up to a limit of insurance. If your bank fails and you have deposits over $ 100,000 federal insurance limit, you may be able to restore some or, in rare cases, all of your uninsured funds. However, the vast majority of depositors at failed institutions are within the insurance limit of $ 100,000.

5. The FDIC deposit insurance guarantee is rock solid. Since the mid-2005, FDIC had $ 48 billion in reserves to protect depositors. Some people say that I said (usually marketing investments, which compete with bank deposits), the FDIC does not have funds to cover depositors' insured funds if an unprecedented number of banks was to fail. This is false information.

6. FDIC pays the depositors quickly after the failure of the insured banks. Most insurance payments in a few days, usually the next working day after the bank closed. They do not believe that spread misinformation, some investment sellers who claim that the FDIC takes years to pay insured depositors.

7. You are responsible for knowing your deposit insurance coverage.

I know the rules, to protect their money.

Posted by wongdezo at 7/01/2009

Labels: skin care,health,insurance,sleep,children Insurance Tips

5 Tips to Finding the Right Dental Insurance Company

0 commentsWith so many dental insurance to choose from it can be daunting task to determine which plan is best for their needs or the needs of your employees. And take note, these needs are very important, as dental care should never be overlooked. There are five tips that can help you discover a plan that is right for you.

1. Consider Online Comparisons - While a trusted broker can provide you with more options to choose from online comparison and dental insurance options can provide the means to ensure the greatest flexibility and price. In the available types are very diverse and online comparison will allow you to see what the plan and will not be able to do.

2. Price comparison - can be easily make quick decisions on the basis of a simple query, however, if you are working with a broker there may be other options that can provide that may reduce the total cost. Again, using an online comparison, you may be able to view all options and all price ranges. This information may provide information to help you select a plan that fits your budget.

3. Benefit Comparison - There are several questions that you should consider when purchasing a dental insurance plan. Here are a few samples to consider.

And I will be able to choose their own dentist?

Y There are select dates and times that a dentist may restrict visits of individuals that are part of a plan?

Y need to insurance co-pay?

4. Find personal needs and goals - Nobody likes change, but you must ask yourself if some components in a dental insurance plan are really need or want. You should see what are your goals for obtaining dental insurance. When you understand your motivation and needs will be better able to select a plan.

5. Understanding the importance of Coverage - Once you understand that dental insurance plan removes a barrier to oral health, and that improving oral health is associated with better physical health, dental insurance plan begins to give meaning.

The main health insurance, dental insurance provides a means to cope with rising costs of dental care. In some cases, premiums for dental insurance is tax deductible.

Posted by wongdezo at 6/30/2009

Labels: skin care,health,insurance,sleep,children Insurance Tips

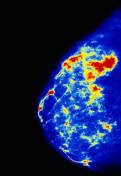

Antiperspirants And Breast Cancer

0 comments

Most underarm antiperspirants contain as the active ingredient, Aluminium Chlorohydrate, as you will probably remember there has been controversy about Aluminium, since the 1950's when it was a popular metal used for making cooking pots, Saucepans and Fry Pans and that it could be one of the contributing factors to Alzheimer's, now we have another problem that could also be related to Aluminium, Breast Cancer.

Research shows that one of the leading causes of Breast Cancer could be the use of antiperspirants. The human body has a number of areas, that it uses to purge Toxins from the body, these are, behind the knees, behind the ears, the groin area, and the armpits. The toxins are purged from the body in the form of perspiration and antiperspirant as the name clearly suggests prevents you from perspiring, thereby inhibiting the body from purging Toxins from the armpit area.

These Toxin do not just disappear, Instead, the body deposits them in the Lymph Nodes below the arms, since it is unable to sweat them out. A concentration of Toxins then builds up in the areas such as the armpits, which can then lead to cell mutations, which is cancer.

It cannot be ignored, that nearly all Breast Cancer Tumors occur in the upper outer quadrant of the breast area, this is where the Lymph Nodes are located. Men are less likely (but not totally exempt) to develop breast cancer prompted by the use of antiperspirants, because the antiperspirant is more likely to be caught in the armpit hair, rather than directly applied to the skin, but ladies, who shave their armpits, increase the risk by causing imperceptable nicks in the skin, which allow the chemicals to enter easily into the body through the armpits.

This article is aimed mainly at ladies, but please be aware that there are a few antiperspirants on the market that are made from natural products, but basically they would still trap the Toxins in the same areas. The best solution is to use deodorants, rather than antiperspirants, also please remember that the Eight Essential Sugars in Glyconutrients can also help to fight off Toxins.

There is a lot of controversy about this article, the medical profession scoff at the idea, and so do big business, but then again there are huge numbers of people that scoff at the problems associated with Fluoride in drinking water. You can make up your own mind on whether there is someting in this article or not, I know that if I was a lady, I would keep clear of Antiperspirants. I realise that Doctors everywhere, do a marvelous job, and they are appreciated, but they are reluctant to look at the bigger picture, also please remember that the fourth largest killer of people in the western world is prescription drugs.

by:Alfred Jones

Posted by wongdezo at 3/19/2009

Labels: skin care,health,insurance,sleep,children Healthy Tips

American Family Health Insurance - What Are The Different Types of American Health Insurance?

0 comments The type of American health insurance you get will all depend on your specific situation and capabilities. Insurance for American families can differ with income bracket, employers, and many other types of issues. This type of insurance is not always just for Americans and Americans living abroad in the armed services. For those who are in the U.S. from other countries and have applied for the immigration process, American family insurance is available for them as well.

The type of American health insurance you get will all depend on your specific situation and capabilities. Insurance for American families can differ with income bracket, employers, and many other types of issues. This type of insurance is not always just for Americans and Americans living abroad in the armed services. For those who are in the U.S. from other countries and have applied for the immigration process, American family insurance is available for them as well.

The Types Of American Family Health Care Plans

There are several types of plans available today. The most common and popular are HMOs and PPOs. These can either be purchased at a lower rate through one's employer or privately for those whose employers do not offer benefits or the self-employed.

American family HMO insurence plans offer customers a set monthly fee for service through their general practitioner and all medical treatment that practitioner refers the customer for within the network set up by the insurance company. You will be able to go see your doctor for treatment and check-ups with no deductible and a small co-pay.

Some HMOs insurence plans offer an indemnity-type option known as a POS plan. In this type of HMO, a POS plan, members can refer themselves outside the plan and still get some coverage. If your personal doctor refers you to a doctor out side of the network you will be fully covered by the plan.

American family PPO insurance plans are for those who would like to pay a lower monthly fee and have more freedom in practitioner choices. Your general practitioner will be in the network provided by your insurance company, but referrals can be outside of your network when appropriate. Customers will also have to meet a deductible each year as well as a co-pay with each visit.

American Family Health Insurance For Families In Need

If you are in need of insurance for your family but are unemployed or at a low-income bracket, you will might qualify for American family insurance through the government. This type of insurance will ensure that you and your family will get the medical treatment you need when you need it at little to no cost to you if you qualify. Medicaid and Medicare are health insurance plans designed to help those in need as well as the elderly and disabled. To find out more about these American family insurance options contact your local federal government agent or Department of Human Services. They will be able to tell you if you qualify and what benefits you are entitled to.

By: Mike Singh

Posted by wongdezo at 2/24/2009